A Senate panel pushed a bill that seeks to provide microenterprises loans with cheaper interest as an alternative to the “5-6” money lending scheme.

The Senate committee on trade, commerce and entrepreneurship has endorsed for plenary deliberations and approval the Senate Bill 2017, which seeks to institutionalize the government’s “Pondo sa Pagbabago at Pag-asenso” program or P3.

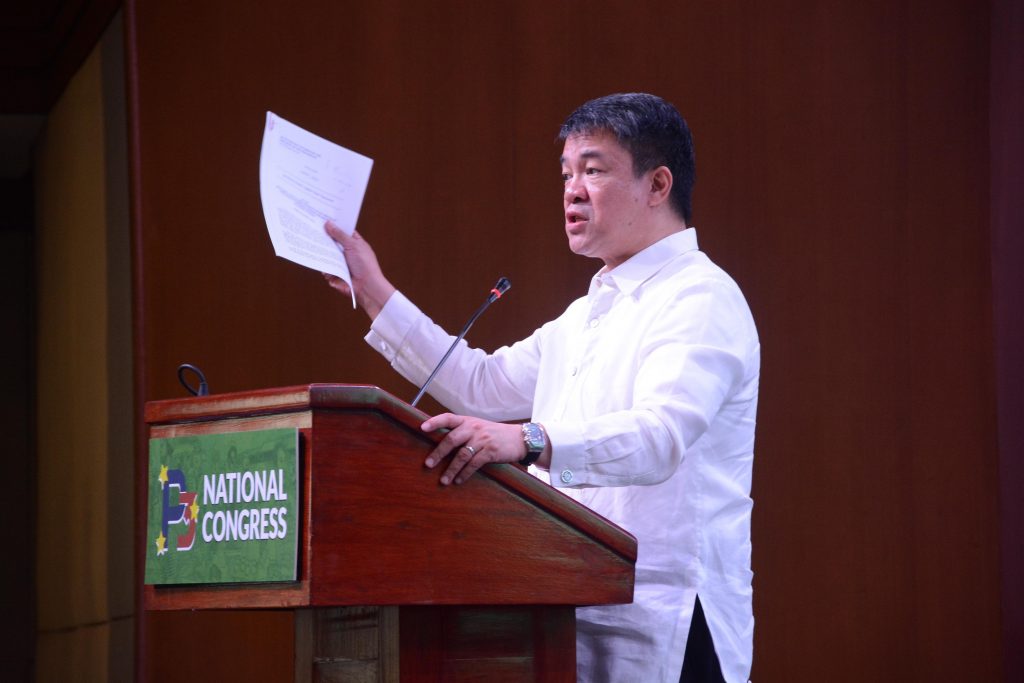

Sen. Aquilino Pimentel III, chair of the committee and author of the measure, said the institutionalization of the P3 program would respond President Duterte’s directive to replace the “5-6” scheme and discourage small businesses to loan from informal lenders.

The P3 program is handled by the Small Business (SB) Corporation, an agency attached to the Department of Trade and Industry.

SB 2017, among others, seeks to “provide an affordable, accessible and simple microfinancing program for the country’s microenterprises, especially those in the poorest provinces.”

The measure, hence, creates the “P3 Fund,” which shall be made available to qualified microenterprises as defined by Republic Act No. 6977, or the Magna Carta for Micro, Small, and Medium Enterprises.

The fund shall be accessible through the SB Corp., or through partner financial institutions, such as rural banks, cooperatives, or lending institutions that are licensed by the Central Bank, Cooperative Development Authority or the Securities and Exchange Commission.

Under the bill, loans would have lower interest, at 2.5 percent per month; and would require no collateral.

The Senate is expected to tackle the measure when it resumes on January 14.

President Duterte had repeatedly vowed to end the “5-6” lending scheme, which he described as a debt trap for poor Filipinos.

The practice involves informal lenders, who usually charge borrowers at least 20 percent monthly interest rate.

Pimentel, in the bill, on the other hand, recognized that businesses still opt to borrow money from them “because of the voluminous and stringent documentary requirements and the need for collaterals when borrowing from formal sectors.”

In 2017 and 2018, Congress had allotted P1 billion for the P3 program.

MANILA BULLETIN

Published December 31, 2018, 4:39 PM

By Vanne Elaine Terrazola